The Foreign Hands That Could Rock The Cradle

Bulgaria's property market was the country's runaway success story last year, providing a record-breaking turnover of 11.36 billion euro, two billion euro more than in 2006. EU accession appears to have further consolidated the country's property boom. Yet we strike a cautionary note for those looking to get rich quick on Bulgarian real estate. Remember that a year ago a meltdown in the Latvian market seemed unthinkable. So did a sharp downturn in the UK. Buying in Bulgaria is not always the lucrative option some may think. Some people still fail to heed the danger of buying off-plan properties. Others overlook renovation and maintenance costs in their bid to make a speculative killing. Besides, are rising prices the sole measure of the sector's vitality? Affordability and building quality, as well as infrastructural and environmental concerns, must also be important. Property should not just be about speculative profit. For most people it's simply an essential prerequisite of human dignity.This time last year we interviewed various property experts to get their take on the coming year. Recently, PropertyWise spoke to the same people to gauge their views on this year's prospects and, in a couple of cases, to offer a post-mortem on where they got it wrong. Predicting future trends is no science, so we do not claim their views to be anything other than subjective opinions from knowledgeable people within the sector.

Nadya Miteva, Architect, Head of Property Development, LOGServices SRE

Forecast in January 2007:

Prices of existing old buildings will go down. Everything old, poorly maintained or of inferior quality will lose value. Prices of newly built buildings will go up.

Reflections on 2007

Bulgaria has preoccupied investors in recent years. It became popular as a holiday destination and was heralded as a low risk opportunity for investors that would accrue high rental dividends.

Following EU accession, Bulgaria adopted various liberal investment laws and regulations. Along with the improvement in the bank mortgage system, these assured the expansion of real estate investments. The trend of the past few years continued during the first three quarters of 2007. Then, suddenly, the market hesitated. Investors' initiatives became more active than local authorities could handle.

Infrastructural deficiencies

Insufficient infrastructure, roads and urban plans blocked the progress of many ambitious projects. Some works in progress suffered as a result. In the middle of last year, foreign real estate agencies categorised most Bulgarian properties as high-risk investments. They were determined not to change their stance until the Government prioritised improving areas around private construction sites.

Buyers expect high quality

Most second home buyers in Bulgaria are Europeans searching for better weather along with high standards of design, construction and service. Clients and developers are starting to appreciate the importance of high quality. Bulgarians started the process of harmonisation and integration with EU counterparts. European specialists, including architects, consultants and engineers, also showed professional interest in designing and developing projects in Bulgaria.

Predictions for 2008

The first few months of this year will be vital for the market. The Government must convince people that European funds for infrastructural improvements will be allocated wisely. On this key issue hinges future development and prices.

We expect previous years' growth to continue but at a slower pace. Prices for quality projects will keep rising by about 15 to 20 per cent. High-class design projects will flow as a result and construction quality will improve. Properties with unfavourable locations as well as those with dubious function and design will lose momentum. These may undergo a levelling off of prices or even fall by up to five per cent.

Tanya Kosseva - Boshova, Executive Director, Landmark Properties Bulgaria Jsc.

Forecast in January 2007

Prices will continue to increase. I do not expect stagnation, nor a decrease in supply and demand. The market will grow...the number of projects will increase and they will be large-scale.

Reflections on 2007

Last year showed that property markets are simultaneously global and local. The British market stalled and succumbed to negative expectations but the Bulgarian market proved resilient. There were ground-breaking ceremonies for several large developments and more deals were finalised. Growing numbers of international investors and developers eyed the Bulgarian market, implying high levels of confidence in Bulgaria. Yields have been squeezed even further. Retail shopping centres are expected to break the seven per cent threshold this year.

Need for transparency

I was slightly disappointed with the lack of transparency of some investment deals last year. Some transactions were not fully reported to the general public in terms of yields and Net Operating Income (NOI). Hopefully, this will improve this year. Investors need transparency to be able to make informed decisions.

The financial crisis of the second half of last year affected Bulgaria. Most retail banks increased mortgage rates, so undermining demand for residential properties. As far as the financing of commercial properties is concerned, margins will probably increase slightly for some projects and banks will be more selective.

A major achievement was the abolition of the restriction on terms of leases beyond 10 years. This is a great stimulus for international developers and large retailers who need 20-30 year leases to secure their investments and trading operations respectively. The American Chamber of Commerce in Bulgaria proved particularly effective in lobbying the Bulgarian parliament.

Predictions for 2008

Last year's trends will continue. Don't expect any major changes in prices or the general dynamics of supply and demand. Shopping centres seemed to be a "fashionable" investment last year. Many projects were announced but this year will show which ones are deliverable. 2008/2009 should also bring logistics under the spotlight - several large projects are in motion and due to break ground soon. The industrial sector needs to catch up with the growing retail sector. As the economy grows, demand for residential properties will continue despite mortgage restrictions. Hopefully, quality will be improved. Several big names from the world of architecture visited Bulgaria last year and some may even undertake projects here.

Lyubomir Stanimirov, CEO ImotiBG

Forecast in January 2007

We may expect stagnation of the market in the first six months of 2007...When all the buildings now in various stages of completion become available on the market, prices of older buildings will fall. Mortgage lending conditions will become stricter and difficulty in securing loans will affect the market.

Overview of 2007

Bulgaria's real estate market did not, in fact, stagnate in 2007. Prices soared beyond pundits' expectations. Average prices in Sofia rose by 30 per cent, surpassing the estimated 15 per cent. However, we had good reason to speak of a standstill in almost all winter and coastal resorts.

The credit market turned out to be more flexible than we thought. Competition was keen among banks. Interest rates on loans recorded a decrease. Prepayment options on part of the loan or the whole principal due were included in lending contracts. Banks started lending to foreign companies. All these factors boosted the property market. This, in turn, drove real estate prices upwards.

Despite the large supply of residential projects in Sofia, almost all were sold off-plan. The market managed to absorb these units because of increased demand for new developments.

Nevertheless, we did not see heated competition or significant improvements in building quality. Several so-called boutique edifices are offering special comfort and style. However, demand was low due to the price-quality factor.

'Old' buildings defied expectations

The greatest surprise in the housing sector came from "old construction" units or prefabs. Prices registered the highest growth rate - compared to projections - and demand far exceeded expectations.

Many people opted for buying "old" homes, motivated by idiosyncrasies of mortgage lending. Banks granted loans after presenting a certificate that the initial construction works are completed, which requires 20 to 30 per cent self-finance.

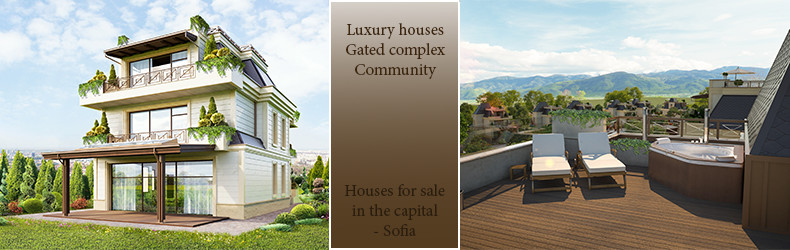

The office market did not shift dramatically last year. Demand and supply were subdued. The coastal holiday property market also offered few major surprises. Notwithstanding significant competition, the segment remained relatively calm. In an attempt to curry favour with clients, developers offered more frills. More gated complexes emerged on the market, usually near attractive sites. These featured more diverse amusement facilities as investors tried to provide buyers with higher standards of care and entertainment.

Prediction for 2008

Sofia's property market expects several interesting office and industrial projects this year. Prices will proceed smoothly without striking fluctuations. Apartments in residential gated communities will offer more attractive prices.

Katya Tsenova, Executive Director, Address Real Estate Agency

Forecast in January 2007 I do not expect a shocking increase in prices. Increases will be in the range of 10 to 15 per cent and will happen gradually. The greatest price hike will affect luxury properties. Probably the first few months of 2007 will be a period of stagnation.

Overview of 2007

Old buildings were more expensive than new ones. This was one of the main trends of the property market in 2007. This was due to stable demand for panel apartments and limited supply. Such tendencies were exhibited in all Bulgaria's big cities except Plovdiv.

In Bourgas, for example, the average price for a pre-fab apartment was 680 euro a sq m, while newly-built apartments could be bought for 517 euro a sq m.

Price increases in old apartment blocks exceeded those of new ones. The greatest increase was recorded in Rousse - 60 per cent, followeed by Varna, 44 per cent, and Sofia, 37.76 per cent.

Market unaffected by rising interest rates

Newly constructed buildings attracted more buyers because of the availablity of bank loans and flexible leasing schemes offered by investors. Greater numbers of people sold their panel apartments and bought new ones. Credit propelled the market and property deals secured via bank loans continued rising. Despite Bulgarian National Bank restrictions and increasing interest rates, the market was active. Two-bedroom apartments remained the most attractive residential dwellings. Purchases were made with an eye to ownership and investment. These apartments were also easy to rent out.

The residential property market saw a dynamic development in Bulgaria's small towns, driven mainly by locals and Bulgarians working abroad. Large-scale investment projects, as well as infrastructural improvements, positively influenced the residential market's development outside the capital. In small towns the number of deals secured with bank loans was larger than in the big cities. Demand for high-quality, luxury residential units stabilised. Hence investors started building large-scale complexes equipped with spa centres and eco-friendly developments.

Russian speakers invaded market

Foreign entrepreneurs still targeted Bulgaria as a good investment destination. Address REA registered a year-on-year rise in the number of deals sealed by foreigners. Russian-speaking buyers entered the market in a big way. Latvians were among the most active Russian-speaking buyers, followed by Russians and Estonians. New players - for example from Kazakhstan - also arrived.

In 2007 there was a decline in English-speaking buyers' interest in Bulgarian properties. British people continued to buy the greatest number of properties, followed by Irish. The number of Greek buyers doubled compared to 2006, Address REA data shows. This was unsurprising in view of Bulgaria's EU accession and Greece's proximity. Romanians also entered the market. At the beginning of 2007 they mostly targeted properties along the border - in Rousse and Silistra - as well as the coastal cities of Balchik and Shabla. Now they are turning to mountain resorts such as Bansko and Razlog.

Forecast for 2008

Bulgaria's property market will continue to develop. Last year, investors were eager to reap the positive consequences and euphoria following Bulgaria's EU accession. The market will now enter a more stable and balanced phase. Good macro-economic indicators, continued foreign investment, stable domestic demand, the development of credit and new projects on the market are all good portents.

Price increases will be more moderate, in the region of 10 to 15 per cent. The hike will be higher for properties in peripheral regions and those of high quality. We expect a dynamic development of the markets in small towns. The full potential of these areas is still untapped. We expect an increasing number of property deals.

In coming years the market will consolidate itself. Larger projects will be offered that will dictate trends and developments. Investors will focus on developing suburban residential areas, satellite villages and gated complexes. Increased supply will deepen market segmentation. Only carefully planned ventures will be successful.

Andy Anderson, Director, Stara Planina Properties

Forecast in January 2007

Prices are lower compared to other overseas property destinations, so interest here will continue to rise...An increasing number of Brits are buying overseas properties...The residential property market is going to develop rapidly.

Reflections on 2007

The steep rise in property prices last year stemmed from several factors. It continued the momentum that had built up in recent years following increases in worldwide property prices and, after all, Bulgaria is now part of this global market. EU accession also accelerated these trends as people decided to invest in property here. In addition, the strong economy boosted domestic demand for residential, retail and office property.

Bulgaria's property market is still very young, hence the absence of a strong historical perspective against which to judge current trends. Bulgaria, for example, has not yet experienced a property crash. Britain's current property slowdown, by contrast, can be measured against the property crashes of previous decades.

Forecast for 2008

There is one universal truth about property - "experts" rarely get it right! Having said that, here are my views. The Bulgarian market will suffer problems related to its rapid growth, the global credit squeeze and a decline in the British property market. This will discourage British investors from buying overseas. Strong evidence points to over-supply of investment/holiday apartments along the Black Sea and in some ski resorts. Serious infrastructural shortcomings will also deter buyers.

The global credit crunch will also place upward pressure on interest rates. This will affect the availability of mortgages in Bulgaria and may have a dampening effect on mortgage demand and domestic residential property.

Is the UK heading for a property crash?

Additionally, after 10 years of unprecedented growth in the UK property market - of up to 300 per cent in London - recent evidence points to falling prices. The Financial Times has even predicted a meltdown. Depending on the severity of a British property dip, I would expect this to undermine British investment overseas.

My own anecdotal evidence points to a drop in prices at major resorts and a levelling off of prices in large towns triggered by diminishing domestic interest. British people wishing to move here permanently will lean more towards rural properties. Prime locations - such as central Sofia, Veliko Turnovo and Rousse - will hold up well due to a combination of continued foreign and domestic demand. Fringe locations and purely speculative developments based on capital gain may suffer more.

Are people being priced out of the property market?

The industry should not focus too much on rising prices, especially if this excludes other important factors such as the quality of the environment and the means to provide the whole population with suitable housing. Markets are merely mechanisms to distribute goods or services. A successful housing market should be judged by its ability to serve society. Homes should be high quality and in places where people want to live. They should also contribute toward modern sustainable cities.

Our problem with property booms is two fold. Firstly, rising prices can make housing unaffordable for some. Those able to climb on the property ladder have no problem. For other people, however, the lower rung becomes ever higher. Secondly, it can encourage poor quality and a surfeit of development in the rush for profits, so failing to distribute quality homes to those in need.

Profits are essential in order to stimulate the growth of professional companies and develop innovation and competition. But these should not detract from other vital concerns. In the UK and Bulgaria this has become a serious problem, with the ratio between earnings and house prices at very high levels. In Bulgaria, widespread property ownership and the extended family unit has mitigated these negative impacts because families frequently own one or more properties. However, it has recently been reported that the earnings to house price ratio in Sofia renders it one of the most expensive cities in Europe. This cannot be desirable long-term.