The market for industrial properties and warehouses in Bulgaria is developing dynamically

Investors look for returns of up to 7 years, but reality shows that it is in the order of 9-11 years, says a consulting company

The dynamics of the warehouse market in Bulgaria remains in 2017. Demand is concentrated on new and modern warehouses and industrial properties, including small areas up to 500 sq m, according to the company's annual analysis.

Investors looking to buy land for logistics and production sites can not yet "swallow" the fact that on the basis of land prices and new construction costs, their returns will be in the order of 9-11 years. Projects with returns of up to 7 years are sought, the report said.

Seasonal demand and rental of warehouses in the cities around the Black Sea coast is not just before the season but also continues during the season, according to the company's data.

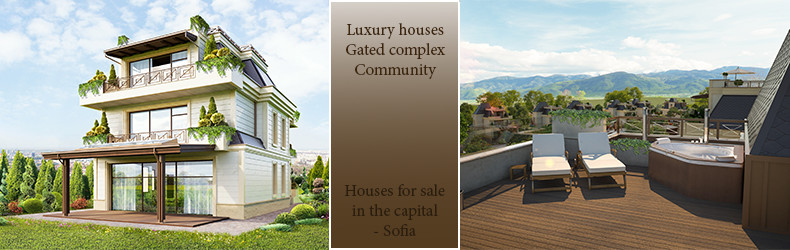

Regarding regional markets, in Sofia last year, the most demanded are warehouses of 1,000 to 5,000 square meters, which correspond to the European requirements, regardless of the price, commented the regional representative of the company.

According to him, the market area of 300 to 700 sq.m. is not particularly active.

He adds that there is an increased demand but a poor supply of refrigeration chambers during the summer season, which continues until now.

They predict that new and big investors will continue to look for good, modern and European-compliant storage space.

In the region of Plovdiv in 2017 there were transactions that were unthinkable until a few years ago. The company's representative for the region commented that the market had catches up with prices, and investors are now more confident, so they are moving to bigger deals. The expert expects the tendency to maintain this year.

Last year the prices of the new warehouses in Plovdiv continued to last about 3-3.5 euros and the prices for production areas ranged from 3 to 4 euros per sq.m. Terrains are rising, prices are in direct relationship with location and adjacent infrastructure and range from 25 to 100 euro per sq m. There is a demand for terrains, as in certain areas because of their exhaustion is strongly increased and the prices are higher.

In Varna the rental levels of production and storage areas are maintained in the approved range between EUR 2 and EUR 4 per sq.m. net monthly.

The demand for newly built storage areas with an area between 300 and 500 sq m is increasing, as well as the demand for licensed warehouses for food products with working areas between 200 and 400 sq. M and self-contained warehouses with temperature regime equipped with refrigeration chambers. Monthly net rental rates for independent cold stores are between EUR 12 and EUR 15 per sq.m for long-term rentals, and there, as in Sofia, there is insufficient supply.

There is an increased interest of tenants to high-class local distributor warehouses for wholesale trade with areas over 1000 sq.m, located in urban modernized bases. The rental levels of such areas are realized in the range between 3.50 and 4 euros per sq.m net monthly price.

An alternative option for renting production areas in a format of more than 2,000 sq. M is a custom-built construction. Such transactions are gaining popularity and are mostly realized on the territory of former factories, which have free construction areas and are equipped with the necessary technical and transport infrastructure for the particular production processes.

A gradual increase in rental levels for Class A warehouses is expected to reach € 4.50 per sq m. Lower-grade warehouses keep rental rates up to 3 euros per sq m.

Intensive demand for commercial locations for combined use as a showroom with a warehouse of more than 500 sq.m at rental levels for shops is 8-12 euros per month and 3-4 euros for warehouses.

There is an increase in the interest in buying commercial and warehousing areas of more than 300 square meters for both own and investment purposes. A determining factor for sales prices is the trading location. There is also growing demand for urban construction sites with investment capacity to build commercial and warehouse bases. Identifying factors are the location and available infrastructure. Price levels on sales of construction sites vary between 70 and 120 euros per sq m, depending on communications and location, mainly land with an area between 2 and 5 acres with a reserved usable building stock are being sought.

Experts point out that outside the urban areas of Varna the demand for specialized logistic warehouses over 2,000 sq m is directly related to the need for combined transport, which is why proximity to the main cargo port Varna-West is a major factor in the choice of location. Proposals for sale of suburban industrial sites are varied, the price being directly dependent on the available technical infrastructure and the distance from the city. Selling prices vary between EUR 10 and EUR 40 per sq m, and deals are mainly made with land ready for construction.

Sales of industrial sites with specialized technical infrastructure for heavy production are realized at levels between EUR 30 and EUR 40 per sq.m. Most of the deals are for areas of 10 to 20 acres, ranging from 2 to 200 decares, mainly located around the Hemus highway.

In Burgas in 2017 the demand for small warehouses is preserved, but with a good location. We are looking for mainly warehouses between 100 and 300 square meters. The price of new and modern warehouses varies between 2 and 3 euros per square meter. in the Northern and Southern Industrial Zone.

The realized deals for 2017 are mainly for warehouses between 200 and 300 sq.m and 500 to 1000 sq.m. For class A in Bourgas the prices are 3 euro per sq m and for class B - 2 euro per sq m - a trend that has been retained since 2016

Average land purchase prices range from 150 to 170 euro per sq m. At present and in 2018 the demand for large areas of 600 to 1500 square meters is preserved.

The Industrial Property Market in Stara Zagora is developing dynamically. The demand for rental areas is growing rather than buying, commented the regional representative of the company Ognian Georgiev. Demand exceeds supply, however, and lack of investors is a problem for market development. This is also a major trend - there are not enough areas for industrial and logistic bases.

However, rent prices remain stable - 5 leva per sq m for Class A plots and 3.5 leva for Class B plots. The average purchase price of industrial plots is around 20 Euros per sq m.

There is a desire to consolidate larger sites for the construction of warehouses, but the process is delayed due to administrative procedures. There is also a growth in investment for the purchase of land for industrial development, but one part is for own needs or expansion of its own bases.

In Pleven, in 2017 there is a stir in the market of industrial and industrial properties, including in the whole Pleven region and in the Lovech region. New production takes place, people are hired, suitable properties for new construction and repair and reconstruction of old buildings are sought.

The main search is for industrial properties, located in industrial zone West, East and Central. Land sales prices in industrial areas remain according to the built infrastructure and access to main arteries at prices from EUR 10-15 per sq m to levels around EUR 30 - 35 per sq m.

For areas between 1 000 - 5 000 sq m the price is between 30 - 50 euro per sq m. Interest in agricultural land is low in terms of re-pricing procedures and great uncertainty when and whether it will be realized and offers vary from 1-2 euros per sq m. For properties with access from the road and near infrastructure, the price can reach 5-7 euros, according to the data of the experts.

The prices of warehouses and industrial premises vary widely, starting at BGN 50 - 100 per square meter for old properties with a large area, reaching about 200-300 Euros per square meter. for properties of good location, new construction or completely renovated.

Rental rates vary from 1-2 leva per sq m excluding VAT per sq m of covered land, warehouse and other old construction and 3-5 leva per sq m without VAT per sq m for well-located properties and access in suitable logistics or commercial development areas targets, where prices are above those levels.

In Rousse, the industrial property market was calm last year. The interest is mainly from foreign investors who buy plots for construction of their own bases. They do not prefer rents because the conditions and premises provided do not satisfy them. Costly investments are needed to accommodate them, which are unjustified.

In Rousse there is a deficit of new warehouses. Most of the deals are for the purchase of warehouses for rent. There are investors with free capital who turn their attention to buying industrial property. Analyzes show that this is a secure investment with a yield of 5-8%.

Rental prices in Rousse of the order of 3-5 leva per sq.m without VAT. Prices of regulated land vary - in Eastern and Western industrial zones prices are around 30-50 euros per square meter, and in the new industrial park are in the order of 15-20 euros.

For Gabrovo there is an increased interest in investors, but in the region the supply of modern areas lags behind. The average prices for purchase of land in regulation for the town of Gabrovo are 17 euro per sq.m and for the region 9 euro. In 2017 there is an increased demand for investment plots in the region. The interest in renting of industrial properties is also up to 2016.